Within the banking industry, becoming proficient in cash flow management is like navigating a ship through harsh seas. It’s essential to any organization since it guarantees efficient operations, prompt payments, and long-term growth. The projected cash flow statement, a potent instrument that projects the inflows and outflows of cash over a given period, is essential to this.

Understanding Cash Flow

Let us first understand the fundamentals of cash flow before diving into the specifics of a projected cash flow statement sample. To put it simply, cash flow is the flow of funds into and out of a business. It provides a comprehensive view of liquidity and financial health by including all cash receipts and payments.

The Importance of Projected Cash Flow Statements

For financial planning, projected cash flow statements act as a road map. Businesses can allocate resources, make expenditure and investment decisions, and estimate future cash flows based on historical data and expected changes. A well-written anticipated cash flow statement is essential for every business, whether you’re a startup looking for capital or an established business planning for expansion.

Crafting a Projected Cash Flow Statement

Now, let’s walk through the process of creating a projected cash flow statement:

- Gather Data: Start by gathering past financial information, such as sales numbers, costs, receivables, and payables. This serves as the basis for your forecasts.

- Forecast Sales: Based on previous results, industry trends, and any impending initiatives, project future sales. Be both practical and upbeat while taking the economy and seasonality into account.

- Predict Expenses: Be prepared for any and all possible expenses, including debt repayment, payroll, taxes, and running costs. Take into account any upcoming investments or expansions that could affect cash flow.

- Account for Timing: Time is just as important to cash flow as money. Take into account when sales and expense cash withdrawals occur. Take into account any potential delays or inconsistencies.

- Create cash flow. Categories: Sort the items in your anticipated cash flow statement into groups, such as financing, investing, and operational activities. This makes things clear and makes analysis easier.

- Calculate Net Cash Flow: Compute the net cash flow by adding together all of the cash inflows and outflows for each period. Liquidity is shown by positive cash flow, but negative cash flow could call for changes or more funding.

- Review and refine: After creating your predicted cash flow statement, carefully go over it. Keep an eye out for assumptions, contradictions, and possible dangers. Make adjustments to your projections in response to feedback and evolving conditions.

Sample Projected Cash Flow Statement

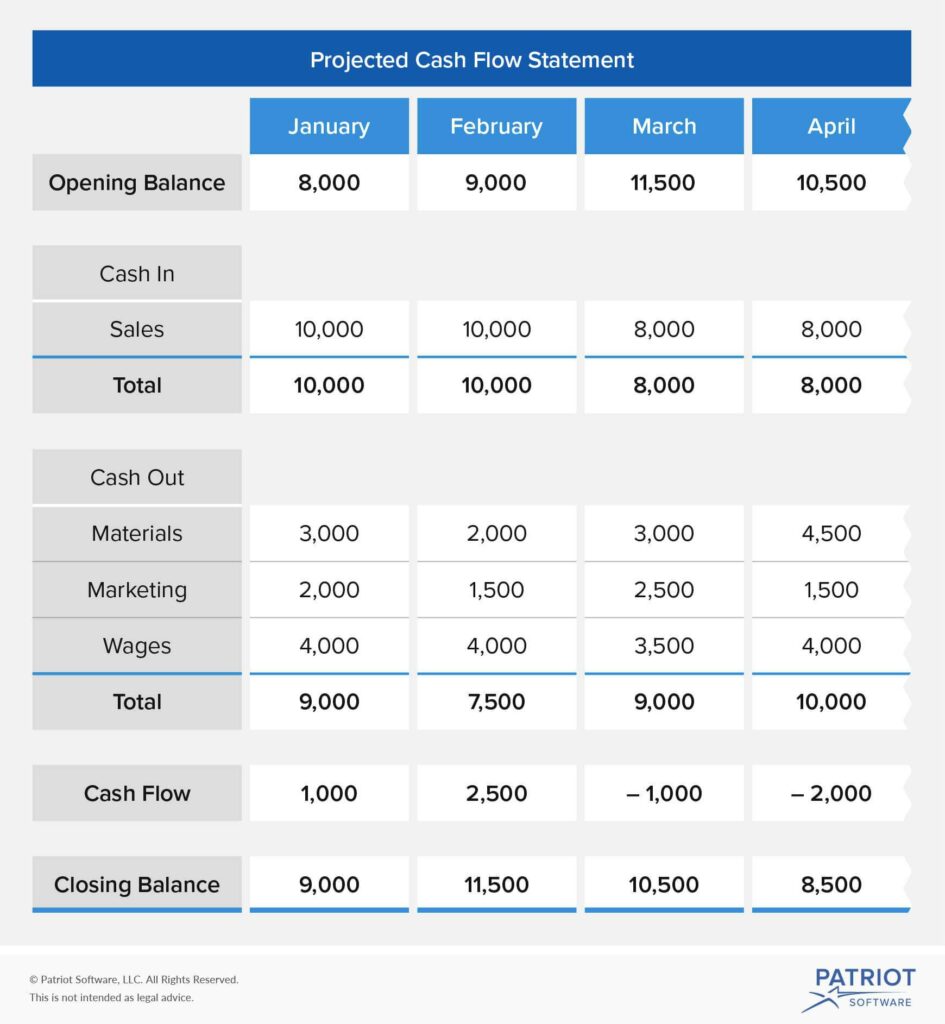

Here’s a simplified example of a projected cash flow statement for a hypothetical small business:

| Month | Cash Inflows | Cash Outflows | Net Cash Flow |

|---|---|---|---|

| January | $10,000 | $8,000 | $2,000 |

| February | $12,000 | $9,000 | $3,000 |

| March | $11,000 | $10,000 | $1,000 |

| April | $13,000 | $11,000 | $2,000 |

| May | $15,000 | $13,000 | $2,000 |

Leveraging Projected Cash Flow Statements

Projected cash flow statements provide insightful information that goes beyond simple recordkeeping and can influence strategic decision-making. Here are a few strategies companies can use to efficiently utilize this financial tool:

- Identifying Cash Shortfalls: Businesses can foresee times when they may have low liquidity or even cash shortages by projecting their cash flows. Equipped with this understanding, they can proactively look for extra funding or make budget adjustments to reduce risks.

- Optimizing Working Capital: Projected cash flow statements help firms manage their working capital by providing insight into the timing of cash inflows and outflows. This could include settling on advantageous terms for payments with suppliers, expediting client collections, or maximizing inventory levels.

- Assessing Financial Health: Businesses can evaluate the stability and health of their finances by routinely examining forecasted cash flow statements. Negative cash flow may suggest unresolved problems that need to be addressed, whereas positive cash flow shows solvency and operational effectiveness.

- Supporting Growth Initiatives: Projected cash flow statements offer crucial advice when thinking about growth activities like acquisitions, expansion, or the introduction of new products. They support the process of determining the best financing options, assessing the viability of these endeavors, and assessing their possible influence on cash flow.

- Facilitating Investor Communication: Projected cash flow statements are essential for new and expanding companies looking for outside investment. They inspire confidence and build trust by giving investors a clear picture of the company’s financial direction, growth prospects, and capacity for profit.

- Monitoring Performance: By comparing predicted and actual cash flow data, organizations may monitor their performance and make necessary adjustments. Variance analysis finds differences between expected and actual results, allowing for quick fixes and ongoing development.

In Summary

In the ever-changing world of business, cash flow is king. A thorough grasp of cash flow dynamics and the astute application of anticipated cash flow statements enable companies to successfully manage risks, seize opportunities, and prosper in a constantly shifting environment.

As you begin your road towards managing your financial flow, keep in mind that information is power. You may set up your company for long-term success and resilience in the face of adversity by becoming an expert at estimating cash flows and utilizing the insights they offer. Accept the potential of forecasted cash flow statements to serve as a beacon of hope for achieving financial success.