In the realm of small business management, financial statements serve as the cornerstone for assessing the health and progress of your enterprise. Whether you’re a budding entrepreneur or a seasoned business owner, having a well-structured financial statement is essential for understanding your company’s financial standing, making informed decisions, and attracting potential investors. In this guide, we’ll delve into the intricacies of crafting a comprehensive Financial Statement For Small Business Template that empowers you to navigate the financial landscape with confidence.

Understanding the Importance of Financial Statements

Financial statements encapsulate vital information about your business’s financial performance, including revenue, expenses, assets, liabilities, and equity. These documents provide invaluable insights into your company’s profitability, liquidity, and overall financial health. By diligently maintaining accurate financial records and regularly updating your statements, you gain a deeper understanding of your business’s financial dynamics, enabling you to identify strengths, pinpoint areas for improvement, and devise strategic plans for growth.

Key Components of a Financial Statement For Small Business Template

- Income Statement (Profit and Loss Statement): This section outlines your business’s revenue and expenses over a specific period, typically monthly, quarterly, or annually. It provides a snapshot of your profitability by subtracting expenses from revenue to determine net income or loss.

- Balance Sheet: The balance sheet offers a snapshot of your company’s financial position at a given point in time, showcasing its assets, liabilities, and equity. It provides valuable insights into your business’s liquidity and solvency.

- Cash Flow Statement: This statement tracks the flow of cash in and out of your business during a specified period, categorizing cash activities into operating, investing, and financing activities. It offers crucial insights into your business’s ability to generate and manage cash effectively.

- Financial Ratios and Analysis: Incorporating financial ratios and analysis into your financial statement provides a deeper understanding of your business’s performance, profitability, efficiency, and liquidity. Key ratios include gross profit margin, net profit margin, return on investment (ROI), and current ratio.

Crafting Your Financial Statement For Small Business Template

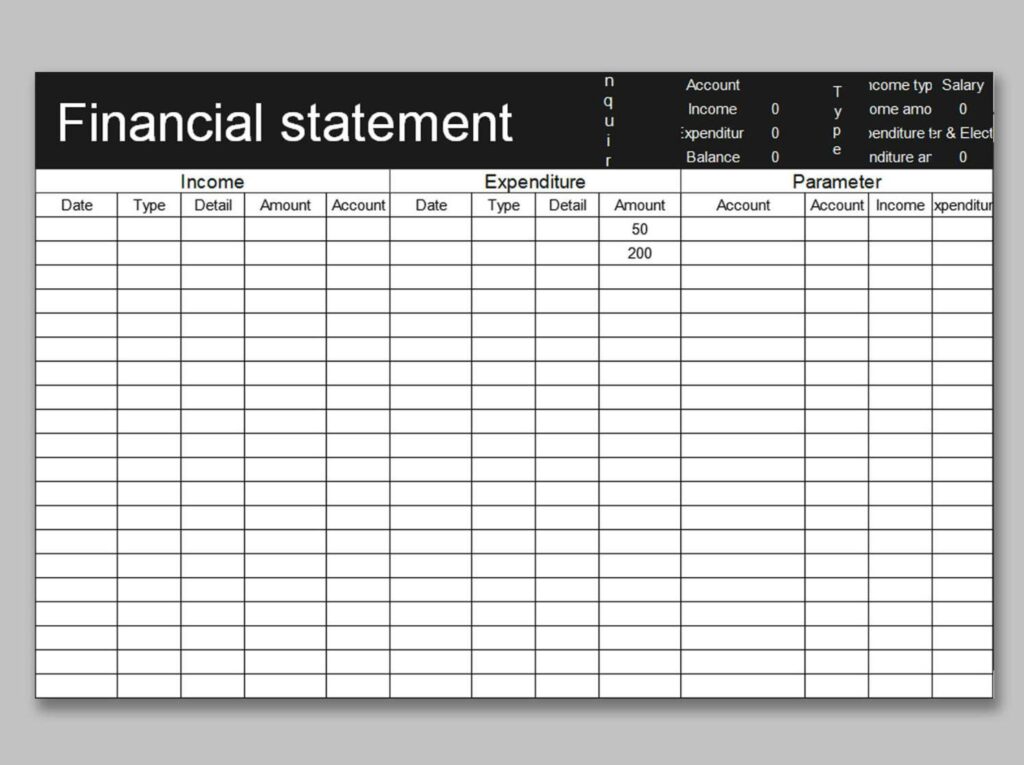

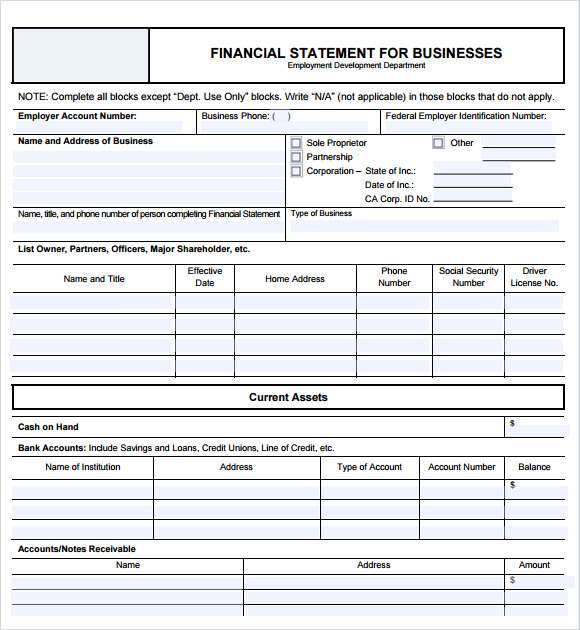

- Choose the Right Software or Template: Select a reliable accounting software or template tailored to small businesses’ needs. Popular options include QuickBooks, Xero, and FreshBooks, offering user-friendly interfaces and customizable templates for generating financial statements.

- Organize Your Financial Data: Gather and organize all relevant financial data, including income, expenses, assets, liabilities, and equity. Ensure accuracy and completeness by reconciling bank statements, invoices, receipts, and other financial documents.

- Customize Your Template: Tailor your financial statement template to suit your business’s specific needs and preferences. Customize categories, labels, and formatting to enhance clarity and usability.

- Update Regularly: Establish a routine for updating your financial statements on a regular basis, whether monthly, quarterly, or annually. Consistent updates ensure that your financial data remains accurate, relevant, and reflective of your business’s current financial status.

- Seek Professional Guidance if Needed: If you’re unsure about certain financial concepts or require assistance in creating your financial statement, don’t hesitate to seek guidance from a financial advisor or accountant. Their expertise can help streamline the process and ensure compliance with regulatory standards.

Embracing Technology for Financial Management

In today’s digital age, leveraging technology is crucial for efficient financial management. Cloud-based accounting software offers numerous benefits, including real-time data access, automatic updates, and seamless integration with other business tools. By harnessing the power of technology, you can streamline your financial processes, reduce manual errors, and gain valuable insights into your business’s financial performance.

Analyzing Trends and Making Informed Decisions

Beyond just recording financial data, your financial statement serves as a strategic tool for analyzing trends and making informed decisions. Regularly reviewing your financial statements allows you to identify patterns, anticipate future challenges, and capitalize on emerging opportunities. Whether it’s adjusting pricing strategies, reallocating resources, or expanding into new markets, informed decision-making based on financial insights is essential for driving sustainable growth.

Communicating Financial Health to Stakeholders

Your financial statement also plays a vital role in communicating your business’s financial health to stakeholders, including investors, lenders, and potential partners. A well-prepared financial statement instills confidence in your business’s stability and growth potential, facilitating smoother negotiations and partnerships. Transparency and accuracy in financial reporting not only foster trust but also enhance your credibility in the eyes of stakeholders.

Continuous Learning and Improvement

As your business evolves and grows, so too should your financial management practices. Treat your financial statement as a dynamic document that evolves alongside your business. Continuously evaluate and refine your financial processes, incorporating feedback and lessons learned along the way. By embracing a mindset of continuous learning and improvement, you can adapt to changing market conditions, mitigate risks, and maximize opportunities for long-term success.

Final Thoughts

In the ever-changing landscape of small business ownership, mastering financial management is paramount to success. By developing a comprehensive Financial Statement For Small Business Template and implementing sound financial practices, you lay a solid foundation for your business’s growth and resilience. Remember, your financial statement is not just a tool for compliance—it’s a strategic asset that empowers you to make informed decisions, communicate effectively with stakeholders, and drive your business toward greater prosperity. Embrace the process, leverage technology, and never underestimate the power of sound financial management in realizing your entrepreneurial dreams.