In today’s fast-paced world, managing personal finances can often feel like navigating through a labyrinth. However, with the right tools and strategies, you can take control of your financial journey and pave the way to a more secure future. One such invaluable tool in the realm of personal finance is the Personal Financial Planning Worksheet. In this article, we’ll explore what these worksheets are, how they can benefit you, and how to effectively utilize them to achieve your financial goals.

Understanding Personal Financial Planning Worksheets

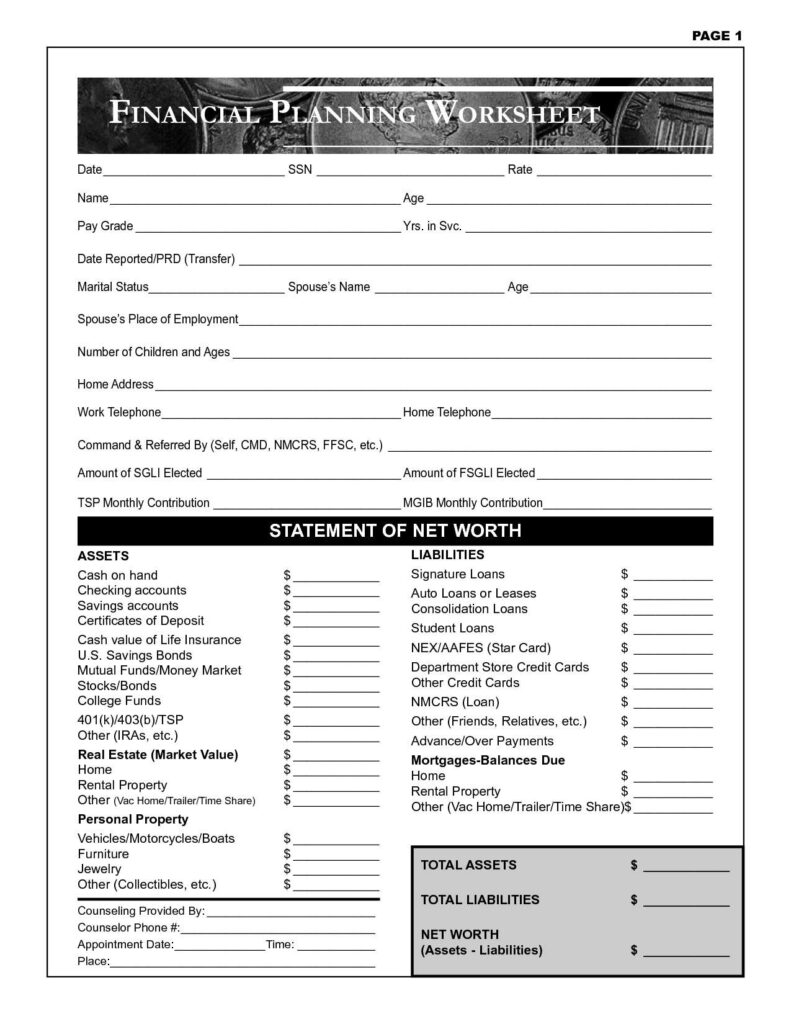

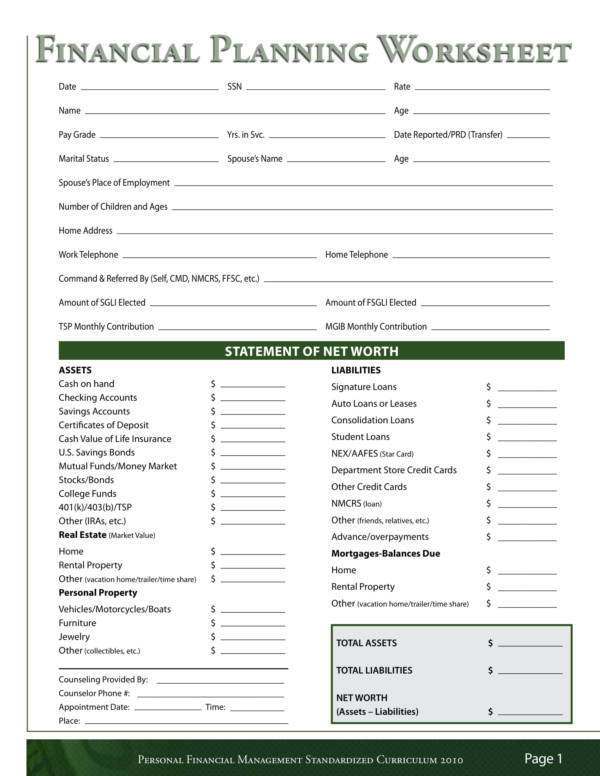

Personal Financial Planning Worksheets are comprehensive tools designed to help individuals assess their current financial situation, set achievable goals, and create a roadmap to reach those goals. These worksheets typically encompass various aspects of personal finance, including income, expenses, savings, investments, debts, and financial goals.

Benefits of Using Personal Financial Planning Worksheets

- Clarity and Organization: One of the primary benefits of using these worksheets is gaining clarity and organization regarding your finances. By documenting your income, expenses, and financial goals in one place, you can get a clear snapshot of your financial standing.

- Goal Setting and Tracking: Personal Financial Planning Worksheets allow you to set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. You can track your progress over time and make necessary adjustments to stay on track.

- Budgeting and Expense Management: These worksheets help you create a realistic budget based on your income and expenses. By identifying areas where you can cut back or reallocate funds, you can optimize your spending and increase your savings.

- Debt Management: If you have debts, Personal Financial Planning Worksheets can assist you in devising a strategy to manage and pay off your debts efficiently. You can prioritize high-interest debts and allocate extra funds toward debt repayment.

- Savings and Investment Planning: Planning for the future is essential, and these worksheets enable you to establish savings goals and investment strategies. Whether you’re saving for retirement, a down payment on a house, or your children’s education, having a structured plan in place is key.

How to Utilize Personal Financial Planning Worksheets Effectively

- Gather Financial Information: Start by gathering all relevant financial documents, including bank statements, pay stubs, bills, investment statements, and debt balances.

- Complete the Worksheet: Fill in the necessary information on the worksheet, such as your income sources, fixed and variable expenses, assets, liabilities, and financial goals.

- Review and Analyze: Once you’ve completed the worksheet, take the time to review and analyze your financial situation. Identify areas where you’re doing well and areas that need improvement.

- Set SMART Goals: Based on your financial analysis, set SMART goals that align with your values and priorities. Whether it’s building an emergency fund, paying off debt, or saving for a vacation, make sure your goals are specific and achievable.

- Implement and Adjust: Put your plan into action and monitor your progress regularly. Be flexible and willing to adjust your plan as life circumstances change.

- Seek Professional Guidance: If you’re unsure about certain aspects of your finances or need personalized advice, don’t hesitate to seek help from a financial advisor or planner. They can provide expert insights and guidance tailored to your specific situation.

- Stay Consistent and Motivated: Consistency is key to financial success. Make it a habit to regularly update and review your Personal Financial Planning Worksheets. Stay motivated by celebrating small victories along the way and reminding yourself of the financial milestones you’re working toward.

- Educate Yourself: Take the time to educate yourself about personal finance concepts, such as budgeting, investing, and retirement planning. There are plenty of resources available, including books, online courses, and workshops, to help you expand your financial knowledge and make informed decisions.

- Embrace Financial Literacy: Building financial literacy is crucial for long-term financial stability. Encourage yourself and others to learn about money management principles, saving strategies, and the importance of living within your means. The more you know, the better equipped you’ll be to navigate financial challenges and opportunities.

- Share Your Journey: Consider sharing your financial journey with friends, family, or online communities. Not only can this provide accountability and support, but it can also inspire others to take control of their own finances and embark on their own financial planning journey.

Conclusion

Personal Financial Planning Worksheets serve as invaluable tools in helping individuals take control of their finances, budget effectively, and work toward achieving their financial goals. By utilizing these worksheets, you can gain clarity, set SMART goals, and pave the way to a brighter financial future. Start your journey toward financial freedom today by incorporating Personal Financial Planning Worksheets into your financial management routine.