In the journey of life, we often overlook the importance of planning for what happens after we’re gone. Estate planning isn’t just for the wealthy or elderly; it’s a crucial step for anyone who wants to ensure their assets are distributed according to their wishes and their loved ones are taken care of in the future. And at the heart of effective estate planning lies a powerful tool: the Estate Planning Worksheet.

Understanding the Estate Planning Worksheet

Think of the Estate Planning Worksheet as your roadmap to organizing your assets and wishes. It’s a comprehensive document that helps you gather all the necessary information to create a solid estate plan. From financial assets to sentimental items, this worksheet covers it all. Let’s break down some key components:

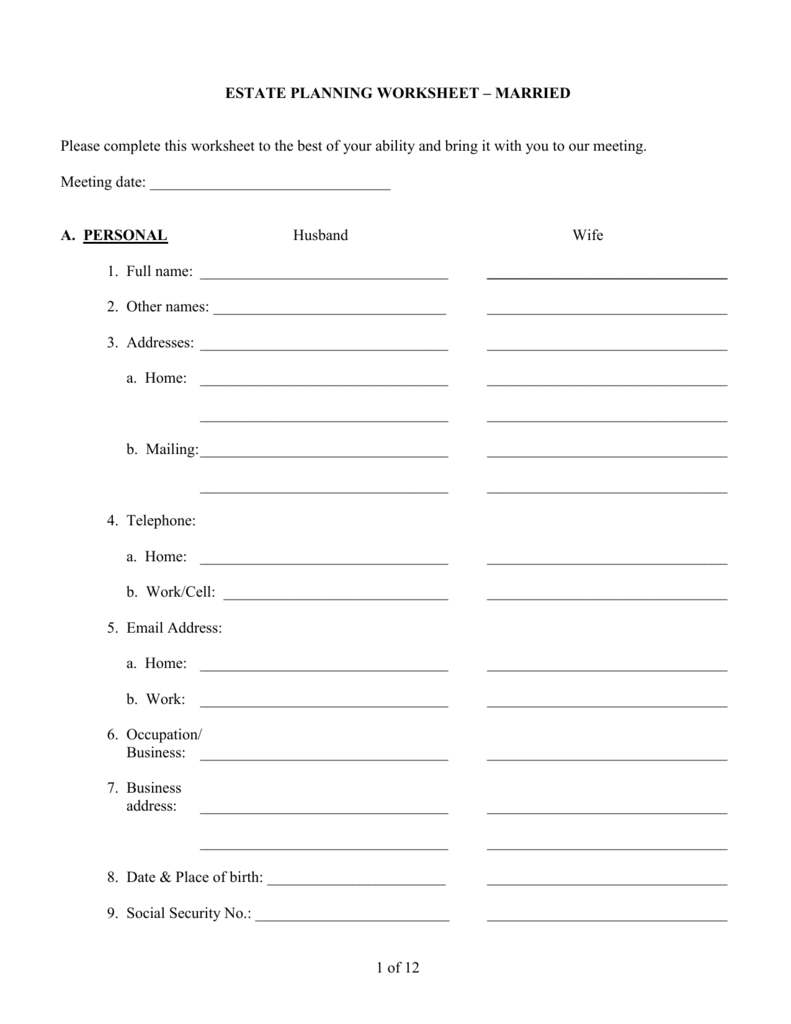

1. Personal Information:

Start by jotting down your personal details, including your full name, date of birth, social security number, and contact information. This section also includes details about your spouse and dependents, if applicable.

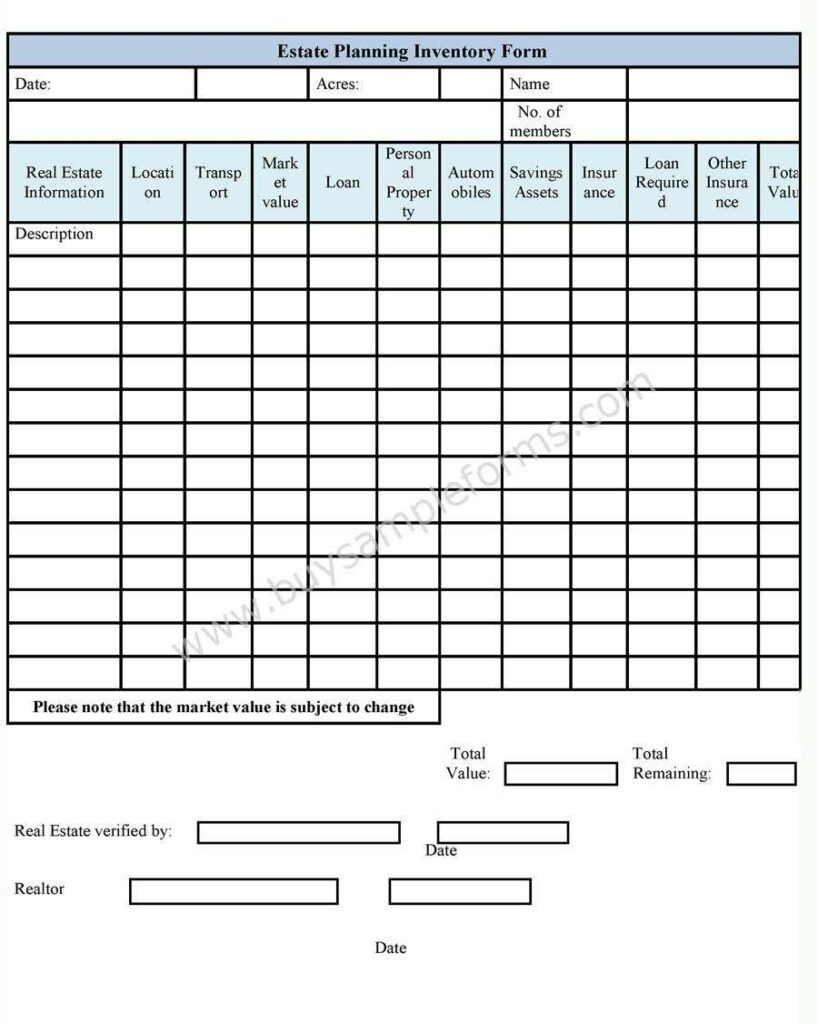

2. Asset Inventory:

Next, list all your assets and their estimated value. This includes real estate, investments, retirement accounts, life insurance policies, and personal belongings. Don’t forget to include any debts or liabilities you may have, such as mortgages or loans.

3. Beneficiary Designations:

Designate beneficiaries for each of your assets. This ensures that your assets are distributed according to your wishes and avoids potential conflicts or legal battles in the future.

4. Executor and Guardianship:

Choose an executor who will be responsible for carrying out your wishes as outlined in your estate plan. If you have minor children, specify guardians who will take care of them in the event of your passing.

5. Advanced Directives:

Include any advanced directives, such as a living will or healthcare power of attorney, to outline your healthcare preferences in case you become incapacitated.

6. Funeral and Final Wishes:

Lastly, document your preferences for your funeral arrangements and any specific instructions you have for the distribution of your assets or sentimental items.

Why Use an Estate Planning Worksheet?

Now, you might be wondering, why go through the trouble of filling out an Estate Planning Worksheet? Here are a few reasons why it’s worth the effort:

- Organization: The worksheet helps you gather all your important information in one place, making it easier for your loved ones to handle your affairs when the time comes.

- Clarity: By clearly outlining your wishes and preferences, you eliminate any ambiguity and reduce the likelihood of disputes among family members.

- Peace of Mind: Knowing that you have a solid estate plan in place gives you peace of mind, knowing that your loved ones will be taken care of according to your wishes.

- Flexibility: Estate planning is not a one-time event; it’s an ongoing process. The worksheet allows you to easily update and modify your estate plan as your circumstances change over time.

Additional Considerations for Estate Planning

As you delve deeper into the process of estate planning, here are some additional considerations to keep in mind:

1. Tax Implications:

Understand the tax implications of your estate plan. Depending on the size of your estate and where you live, there may be estate taxes or inheritance taxes to consider. Consulting with a tax advisor can help you minimize tax liabilities and maximize the value of your assets for your beneficiaries.

2. Review and Update Regularly:

Your estate planning needs may change over time due to various life events such as marriage, divorce, birth of children, or changes in financial circumstances. It’s essential to review and update your estate plan regularly to ensure it remains current and reflective of your wishes.

3. Communication:

Open communication with your loved ones about your estate plan is crucial. While it may be a sensitive topic, discussing your wishes openly can help avoid misunderstandings and conflicts down the road. Make sure your executor and beneficiaries are aware of their roles and responsibilities.

4. Professional Guidance:

Consider seeking professional guidance from an estate planning attorney or financial advisor. They can provide valuable insights and expertise to ensure your estate plan is comprehensive and legally sound. While it may involve some upfront costs, the peace of mind and protection it provides are invaluable.

5. Consider Charitable Giving:

If philanthropy is important to you, consider incorporating charitable giving into your estate plan. You can leave a legacy by donating to your favorite charities or setting up a charitable trust to support causes that align with your values.

6. Digital Assets:

In today’s digital age, don’t forget about your digital assets such as online accounts, social media profiles, and cryptocurrency. Include instructions for how you want these assets to be managed or transferred to your beneficiaries.

7. Long-Term Care Planning:

Long-term care planning is an essential aspect of estate planning, especially as you age. Consider options such as long-term care insurance or setting aside funds for potential healthcare expenses in your estate plan.

Getting Started with Your Estate Planning Worksheet

Ready to take control of your legacy? Start by downloading a template for an Estate Planning Worksheet or consult with a professional estate planner who can guide you through the process. Remember, estate planning is not just about protecting your assets; it’s about leaving a meaningful legacy for future generations.

In conclusion, the Estate Planning Worksheet is a powerful tool that can help you navigate the complex world of estate planning with confidence and clarity. By taking the time to fill out this worksheet and create a comprehensive estate plan, you can ensure that your legacy lives on for years to come.