Within the ever-evolving realm of finance, option trading is a very adaptable and dynamic approach for investors. Using an option trading spreadsheet to its full potential will greatly improve your trading performance, regardless of your experience level. We’ll go into the nuances of option trading spreadsheets in this extensive article, covering their features, advantages, and how to use them to your advantage to increase profits.

Understanding Option Trading Spreadsheets

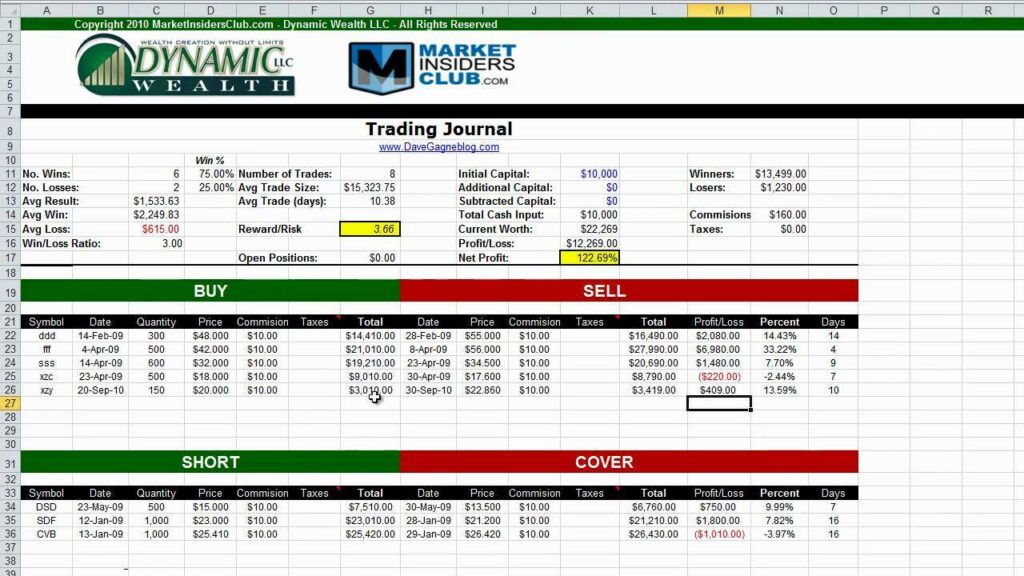

Let’s define what an option trading spreadsheet is first before getting into the specifics. In essence, it’s a program made to assist traders with position analysis, tracking, and management. Consider it your personal digital assistant in the trading world, offering you structure and insightful information.

Benefits of Using an Option Trading Spreadsheet

- Organization: Keeping your trading operations structured is one of the main benefits of using a spreadsheet. You may keep a comprehensive picture of your positions by entering data like option contracts, strike prices, expiration dates, and more with ease.

- Risk Management: When it comes to option trading, effective risk management is essential, and a spreadsheet can be a useful tool in this respect. Through the input of crucial criteria like position size, stop-loss levels, and risk-reward ratios, you may evaluate the possible hazards involved in every trade and modify your strategy accordingly.

- Analysis and Strategy Optimization: You can undertake a thorough analysis of your trading performance and gradually improve your tactics with the help of an option trading spreadsheet. Metrics like win rate, profitability, and average returns can be tracked to help you spot patterns and trends that will help you make better trading decisions in the future.

- Real-Time Monitoring: Real-time data updates are possible with many sophisticated spreadsheets, giving you the ability to keep an eye on market moves and watch the performance of your positions with exactitude up to the minute.

![]()

How to Create an Option Trading Spreadsheet

Creating your own spreadsheet for option trading doesn’t have to be difficult. Here’s a fundamental structure to get you going:

- Input Fields: The option symbol, strike price, expiration date, premium paid or received, and current market price are examples of important data points that should be included in columns.

- Calculations: Include formulas that will automatically compute metrics such as Greeks (delta, gamma, theta, and vega), profit/loss, and break-even points.

- Charts and graphs: At a glance, visual aids like these can offer insightful information. To visually represent important indicators like portfolio diversity or P&L over time, think about adding graphs or charts.

- Risk Management Tools: Put in place tools to monitor risk metrics like portfolio volatility, maximum drawdown, and position size restrictions.

Tips for Using Your Option Trading Spreadsheet Effectively

- To make sure your spreadsheet is effective, make sure you regularly update it with timely and correct data.

- Use conditional formatting to draw attention to crucial details or identify possible dangers.

- Before investing actual money, backtest your trading techniques on historical data to determine their validity.

- Make constant improvements to your spreadsheet in accordance with your changing trading goals and style.

Exploring Advanced Features

When you gain more experience with using an option trading spreadsheet, you might want to look into its advanced features to maximize its potential. The following are some extra features you might think about adding:

- Scenario Analysis: Model different market conditions and evaluate how your portfolio would be affected by them. This might assist you in anticipating various situations and making wise choices in the moment.

- Automated Alerts: Create alerts in your spreadsheet to get notified when important things happen, such as price changes, option expirations, or portfolio milestones. This guarantees that you remain knowledgeable and are able to respond quickly to shifting market conditions.

- Integration with Trading Platforms: You can import data straight into your spreadsheet for easy tracking and analysis with some spreadsheets that offer integration with well-known trading platforms.

- Monte Carlo Simulation: Use Monte Carlo simulation techniques to evaluate the risk of your portfolio in various scenarios and predict the probability distribution of possible outcomes.

Case Study: Maximizing Returns with an Option Trading Spreadsheet

Let’s look at a hypothetical case study to demonstrate how an option trading spreadsheet might be used in practice:

Scenario: You trade options and have a rather positive view of a specific stock. You choose to use a bull call spread strategy in order to minimize downside risk and profit from your bullish leaning.

Using Your Spreadsheet: You enter the strike prices, expiration dates, and premiums for the bull call spread, along with other pertinent information, into your spreadsheet. The parameters in your spreadsheet, like break-even points and maximum profit and loss, are automatically calculated.

Analysis: You perform scenario analysis with your spreadsheet, modeling various price moves and expiration outcomes. This enables you to evaluate the possible profitability of your plan in different situations and modify it as necessary.

Monitoring and Adjustments: You can use your spreadsheet to track the performance of your bull call spread in real-time. You are able to recognize the need to modify your position and take the necessary action as soon as the market conditions alter or your initial thesis is no longer valid.

Results: You may efficiently manage risk and optimize profits with the help of your option trading spreadsheet’s insights. You’re well-positioned for success in the fast-paced world of options trading thanks to your methodical approach to trading and the analytical capabilities of your spreadsheet.

Last Words

To sum up, an option trading spreadsheet is a useful tool that may help you reach your financial objectives, make well-informed judgments, and maximize your trading tactics. You may confidently and precisely handle the complexity of the options market by utilizing its analytical insights, risk management tools, and organizational capabilities. So why not use the power of an option trading spreadsheet to realize the full potential of your trading trip right now?