In the journey toward homeownership, understanding and managing finances play pivotal roles. Among the myriad tools available, one often underestimated yet incredibly powerful resource is the humble home loan spreadsheet. In this article, we’ll delve into the significance of using a home loan spreadsheet, how it can streamline your financial planning, and provide insights into securing your dream home.

Why a Home Loan Spreadsheet Matters

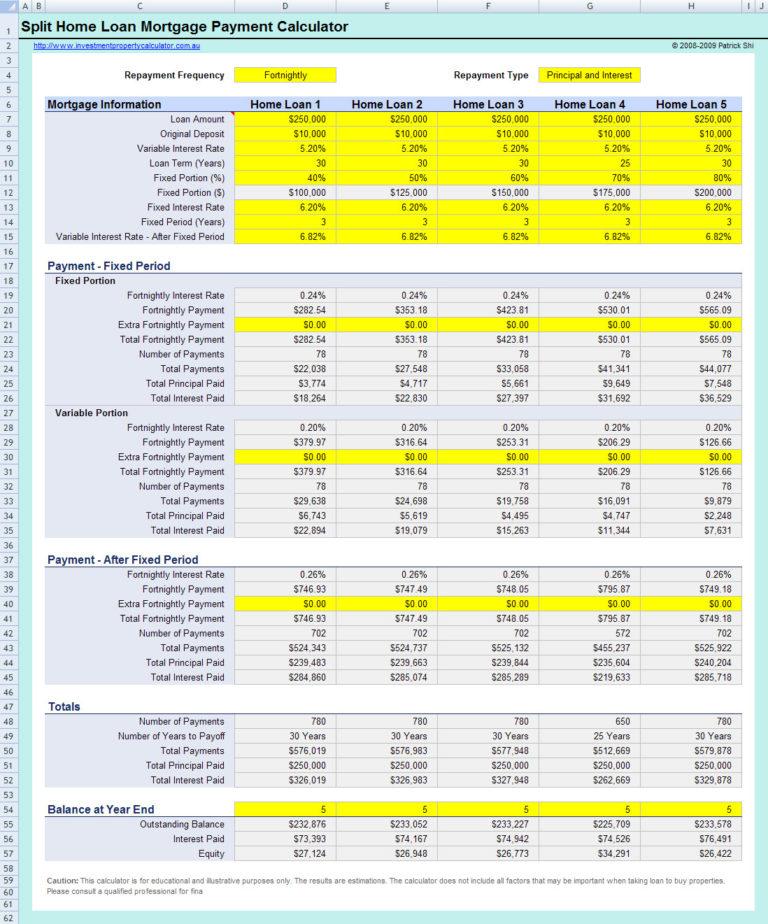

Picture this: You’re contemplating taking out a home loan, but the complex web of interest rates, loan terms, and repayment options feels overwhelming. Enter the home loan spreadsheet – your trusty ally in navigating this intricate landscape. By inputting crucial details such as loan amount, interest rate, and term length, you can visualize various scenarios and understand the long-term implications of your borrowing decisions.

Organizing Your Financial Landscape

A home loan spreadsheet serves as more than just a number-crunching tool; it’s a financial compass guiding you toward your homeownership goals. By categorizing income, expenses, and savings alongside your loan details, you gain a comprehensive view of your financial health. This holistic approach enables informed decision-making, helping you allocate resources efficiently and prioritize your home loan repayment strategy.

Empowering Decision-Making

One of the most significant advantages of utilizing a home loan spreadsheet is its ability to empower you as a borrower. Armed with accurate data and clear projections, you can compare loan offers from different lenders, negotiate terms confidently, and identify potential pitfalls before they arise. Whether you’re a first-time homebuyer or refinancing an existing mortgage, having a structured approach can make all the difference.

Strategic Debt Management

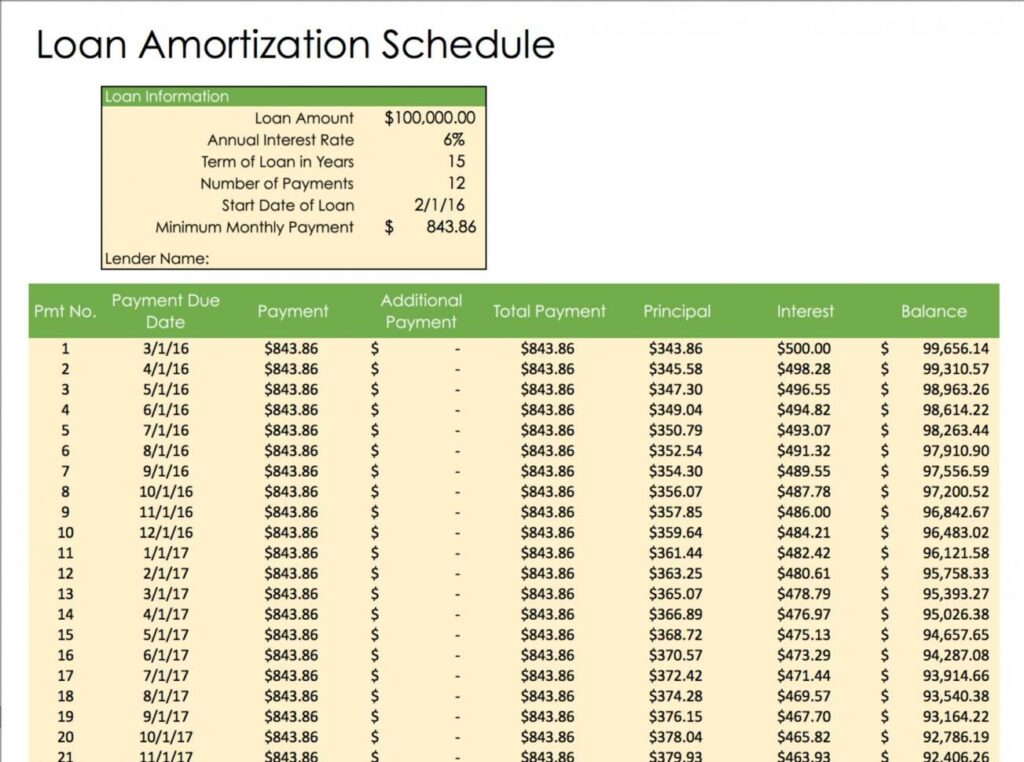

Effective debt management is essential for long-term financial stability, and a home loan spreadsheet can be your ally in this endeavor. By incorporating additional features such as amortization schedules and extra payment calculators, you can devise strategies to accelerate debt repayment and save on interest costs. Moreover, tracking your progress over time fosters accountability and motivates you to stay on course toward debt-free homeownership.

Planning for the Future

Beyond immediate concerns, a home loan spreadsheet equips you with the foresight to plan for the future confidently. Whether it’s anticipating changes in interest rates, exploring refinance opportunities, or preparing for unexpected expenses, having a centralized financial tool ensures you’re always one step ahead. By continuously updating and refining your spreadsheet, you cultivate financial resilience and adaptability in an ever-changing landscape.

Conclusion: Empower Your Homeownership Journey

In the realm of homeownership, informed decisions are the cornerstone of success. By harnessing the power of a home loan spreadsheet, you take control of your financial destiny and pave the way toward achieving your dreams. From evaluating loan options to managing debt strategically, this versatile tool serves as your compass in navigating the complexities of home financing. So, embrace the spreadsheet, unlock its potential, and embark on your journey to financial freedom with confidence.