It’s critical to manage finances effectively in the fast-paced world of today. Keeping up with your financial data is essential for reaching your financial objectives and making wise decisions, regardless of whether you own a small business, work as a freelancer, or are just managing your personal affairs. Presenting the Monthly Financial Report Excel Template, an effective instrument aimed at streamlining financial monitoring and evaluation. In this guide, we’ll look at how to utilize this template to its fullest potential in order to gain insightful knowledge about your financial situation.

Understanding the Importance of Monthly Financial Reports

Let’s first understand the need for monthly financial reports before getting into the Excel template’s intricacies. These reports give you a quick overview of your financial success over a given time frame, usually a month. Through consistent examination of these reports, you may spot patterns, keep tabs on spending, keep an eye on income sources, and evaluate your overall financial well-being. They also provide a foundation for strategic planning and decision-making, helping you to allocate resources wisely and pinpoint areas in need of development.

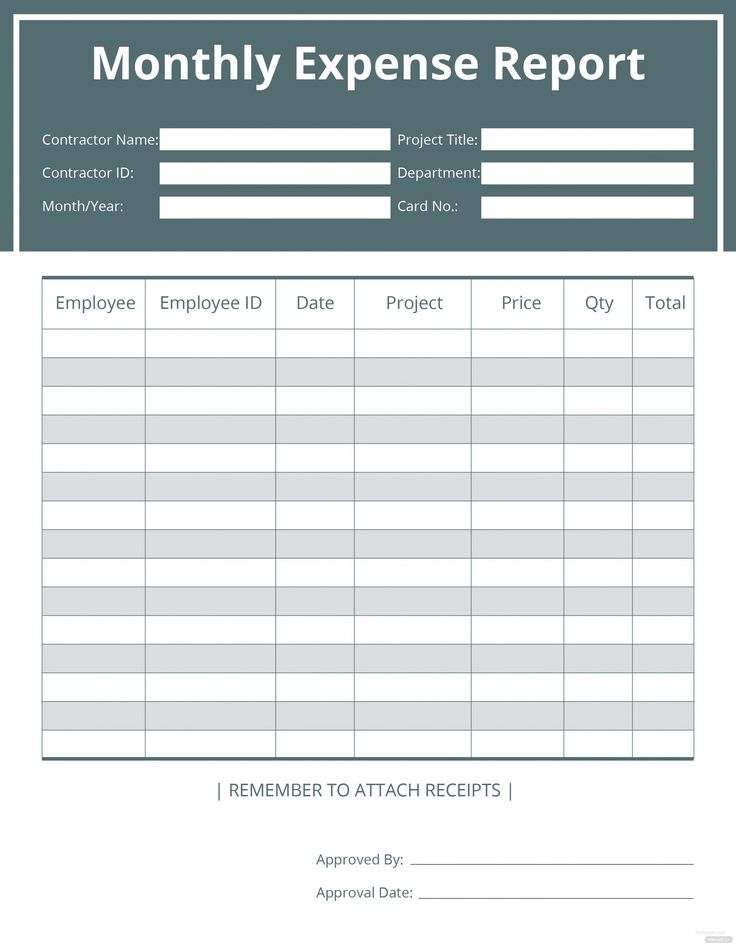

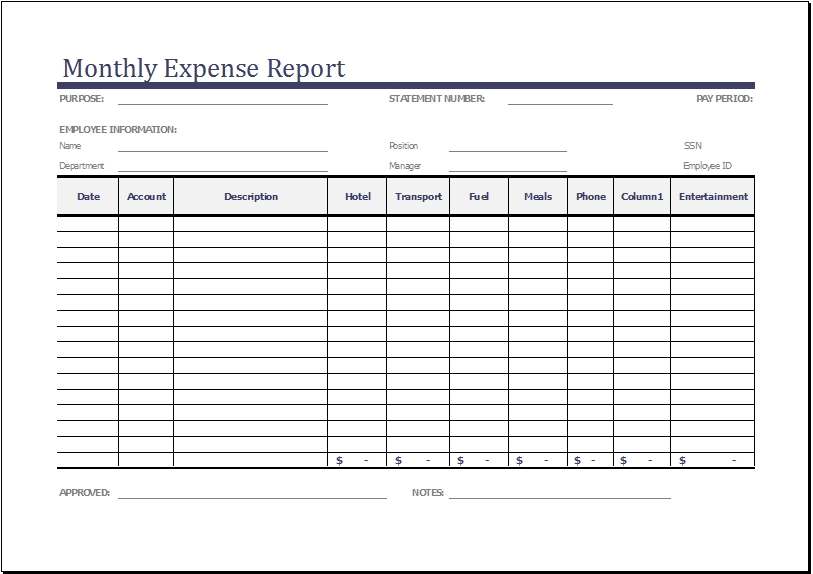

Introducing the Monthly Financial Report Excel Template

Let’s now explore the subject at hand, which is the Monthly Financial Report Excel Template. This template provides an organized framework for financial data organization, which facilitates analysis and interpretation. Below is a summary of its main elements:

- Income Statement: Your monthly net income, expenses, and revenues are shown in this section. It presents a concise summary of your financial performance and identifies your strong and weak points.

- Balance Sheet: This is a summary of your equity, liabilities, and assets as of a particular date. You can evaluate your liquidity and solvency and comprehend your financial situation with the aid of the balance sheet.

- Cash Flow Statement: Working capital management and liquidity preservation depend on keeping track of cash inflows and outflows. The template’s cash flow statement provides an overview of your cash management procedures by classifying cash movements into operating, investing, and financing activities.

- Financial Ratios and Metrics: The template may incorporate computations of important financial ratios and metrics in addition to the fundamental financial statements. These measures, which include profitability, liquidity, and efficiency ratios, give you a better understanding of your financial performance.

How to Use the Template Effectively

Now that you know what the parts are, let’s talk about how to use the Monthly Financial Report Excel Template:

- Consistent Data Entry: To preserve the integrity of your financial reports, make sure that data entry is correct and consistent. To prevent mistakes, verify numbers two times and accurately classify transactions.

- Regular Updates: Set a schedule for updating your financial reports, ideally on a monthly basis. Timely updates ensure that your reports reflect the most recent financial data, enabling you to make informed decisions.

- Customization: Establish a regular update schedule for your financial reports, preferably once a month. You can make wise judgments because your reports will always represent the latest financial facts, thanks to timely updates.

- Analysis and Interpretation: Spend some time interpreting and analyzing the data that is displayed in your financial reports rather than just entering it. Examine patterns, deviations, and areas for development; utilize these findings to guide your financial plan.

Enhancing Your Financial Management Journey

To get the most out of the Monthly Financial Report Excel Template as you start your financial management journey, take into account these extra pointers and techniques:

- Set clear goals: Establish clear financial targets and goals to direct your work. Whether your goals are to improve cash flow, cut costs, or increase profitability, setting specific targets will help you stay motivated and focused.

- Monitor Key Performance Indicators (KPIs): Determine and monitor the main performance metrics that are important to your personal or professional budget. These indicators assist you in tracking your objectives and offer insights into important performance areas.

- Seek Professional Advice: Don’t be afraid to ask financial specialists for advice if you have questions regarding specific financial matters or need help understanding your reports. Accountants, financial planners, and business consultants are able to provide insightful advice specific to your circumstances.

- Embrace Continuous Improvement: Adopt a mindset of constant improvement because managing finances is a continuous activity. To take advantage of new opportunities and adjust to changing conditions, examine and improve your financial reports and strategy on a regular basis.

- Stay Informed: Stay up-to-date on economic, legislative, and industry issues that could affect your finances. Being knowledgeable enables you to foresee difficulties and make proactive adjustments to your financial plans in response.

- Utilize Software Solutions: Although Excel templates are easily downloadable and adaptable, for more sophisticated features and automated capabilities, look into specialized financial management software. Numerous platforms provide integrated financial analysis, forecasting, and budgeting solutions that will streamline your process and increase productivity.

Empowering Financial Success

To sum up, it takes commitment, self-control, and the appropriate resources to become an expert in financial management. In this attempt, the Monthly Financial Report Excel Template is an invaluable ally, offering a disciplined framework for the organization, analysis, and interpretation of financial data. By using best practices and maximizing their potential, you may improve your financial performance, make well-informed decisions, and ultimately succeed more in both your personal and professional efforts.

So, don’t pass up this chance to improve your money management procedures. Open a world of opportunities for a better financial future by downloading the Monthly Financial Report Excel Template and starting your road towards financial empowerment. Keep in mind that this is where your financial success begins!